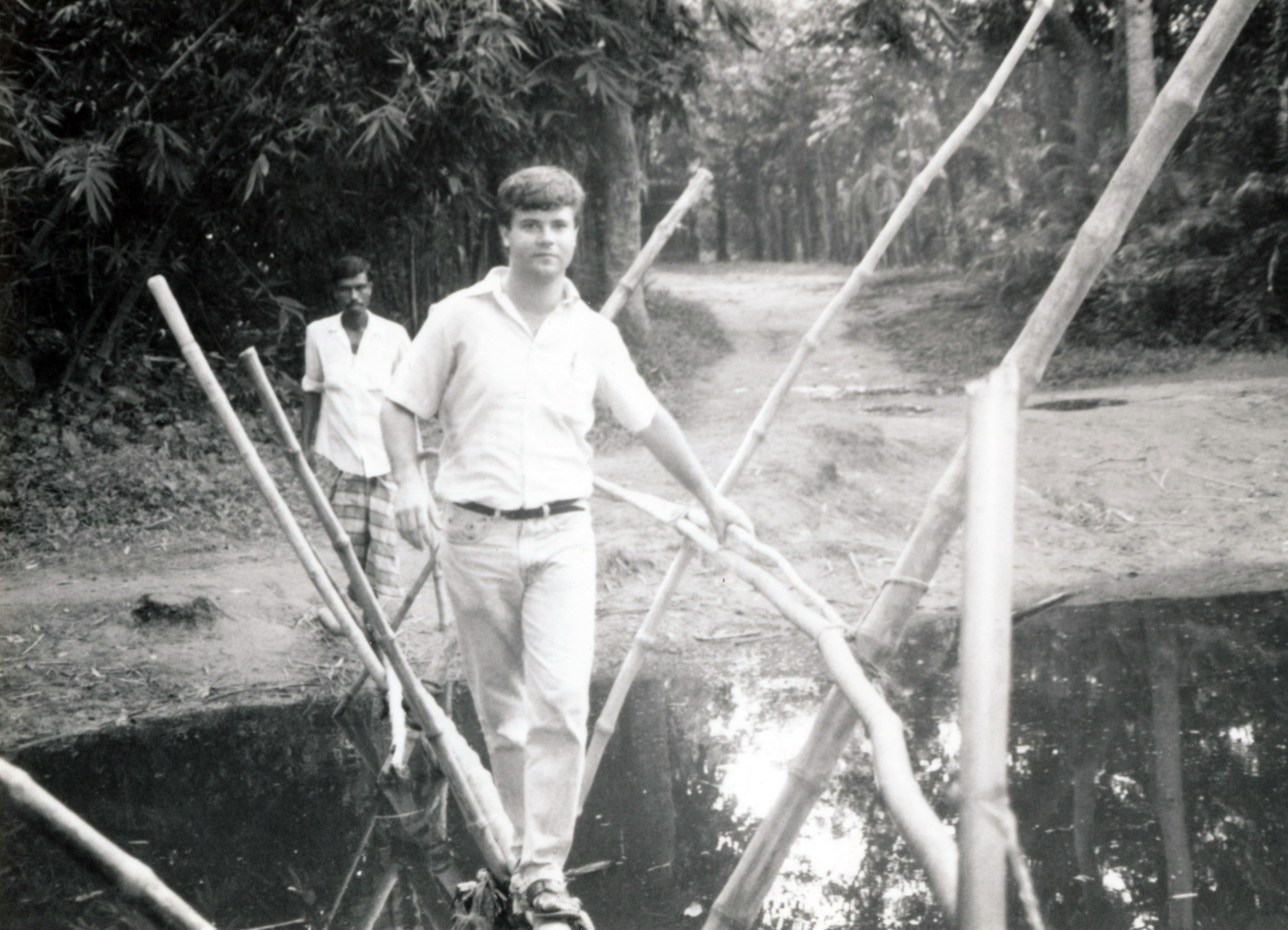

Alex Counts, 1988-1989, Bangladesh, crossing a bamboo bridge at the time of the 1989 monsoon during his Fulbright year

From my earliest days contemplating my responsibilities as a global citizen, I have believed that entrepreneurship, and in particular social entrepreneurship, had major roles to play in realizing a better world. For this reason, I was attracted to the idea of microfinance and one of its earliest and most successful examples: the Grameen Bank of Bangladesh. This innovative financial institution, which served and was owned by this nation’s poor women, was both an entrepreneurial venture itself that made a modest profit most years, but was also an engine of spurring micro-entrepreneurship on a massive scale through the hundreds of millions of business loans it has provided.

Indeed, I have come to believe that one of the surest paths to sustainable and large-scale social change is to incorporate the discipline of the private sector into empowerment strategies. The Grameen Bank and, later, its affiliated companies, was a shining example of this. During my studies at Cornell, I began a correspondence with Professor Muhammad Yunus, Grameen’s founder, about how I could join forces with him to promote his success model at the international level. He welcomed me to come to Bangladesh after graduation to begin our collaboration.